In this week’s recap: unemployment reaches an historic high, while stocks climbed in response to economic re-openings.

THE WEEK ON WALL STREET

Despite an historic downturn in employment, stocks managed to climb higher last week as investors were emboldened by the pace of economic re-openings here and abroad.

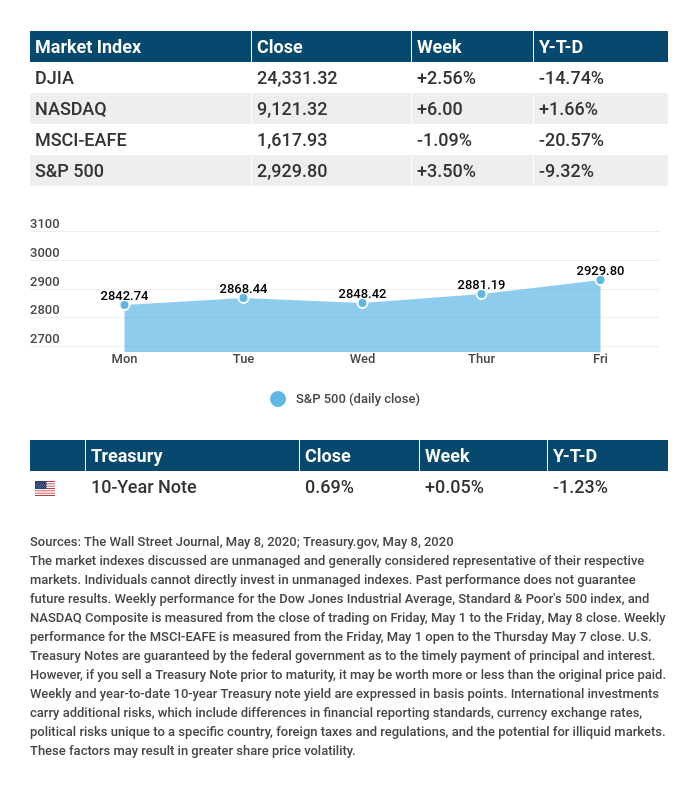

The Dow Jones Industrial Average gained 2.56%, while the Standard & Poor’s 500 advanced 3.50%. The Nasdaq Composite Index jumped 6.00% for the week. The MSCI EAFE Index, which tracks developed overseas stock markets, slipped 1.09%.1,2,3

Tech Stocks Power NASDAQ

Last week’s trading was driven by a crosscurrent of emotions — worries about weak corporate earnings and pace of business re-openings as well as optimism over the pickup in economic activity and progress on developing a vaccine.

Stocks posted back-to-back daily gains to end the week despite troubling employment data. Perhaps the headline of the week was that the technology-heavy NASDAQ Composite Index moved into positive territory year-to-date.1,2

A “Silver Lining” in the Jobs Report?

Last week brought into stark focus the number of jobs lost since the start of the economic shutdown. Since mid-March, unemployment insurance claims have reached 33.5 million. The pace of newly unemployed has slowed down, however, with recent weeks at about half the rate at the peak in late March.4,5

April’s employment report, released on Friday, saw a spike to 14.7% in the unemployment rate. As severe as these numbers may be, 88% of April’s newly unemployed characterized their job loss as temporary rather than permanent, as opposed to 47% of the newly unemployed in March who said their job loss was temporary.6,7

T I P O F T H E W E E K

Do you and your spouse have very similar investment portfolios? As a couple, you might want to approach the goal of investment diversification from a joint (rather than strictly individual) viewpoint.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Consumer Price Index.

Thursday: Jobless Claims.

Friday: Retail Sales; Industrial Production.

Source: Econoday, May 8, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Under Armour (UAA), Simon Property (SPG), Caesars Entertainment (CZR).

Wednesday: Cisco Systems (CSCO).

Source: Zacks, May 8, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Q U O T E O F T H E W E E K

![]()

“Laughter is inner jogging.”

NORMAN COUSINS

T H E W E E K L Y R I D D L E

You buy 10 shrubs. How can you plant them in five rows with four in each row?

LAST WEEK’S RIDDLE: Can you name three words in everyday English that begin with the letters “dw”?

ANSWER: Any three of these five words will do: dwell, dwelling, dwarf, dweeb, and dwindle.

Jon may be reached at 931-759-3307 or 615-809-6808 and at jon.robertson@cambridgesecure.com

Know someone who could use information like this?

Please feel free to send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

«RepresentativeEmailDisclosure»

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

CITATIONS:

1 – The Wall Street Journal, May 8, 2020

2 – The Wall Street Journal, May 8, 2020

3 – The Wall Street Journal, May 8, 2020

4 – CNBC, May 6, 2020

5 – CNBC, May 6, 2020

6 – The Wall Street Journal, May 8, 2020

7 – The Wall Street Journal, May 8, 2020

CHART CITATIONS:

The Wall Street Journal, May 8, 2020

The Wall Street Journal, May 8, 2020

Treasury.gov, May 8, 2020